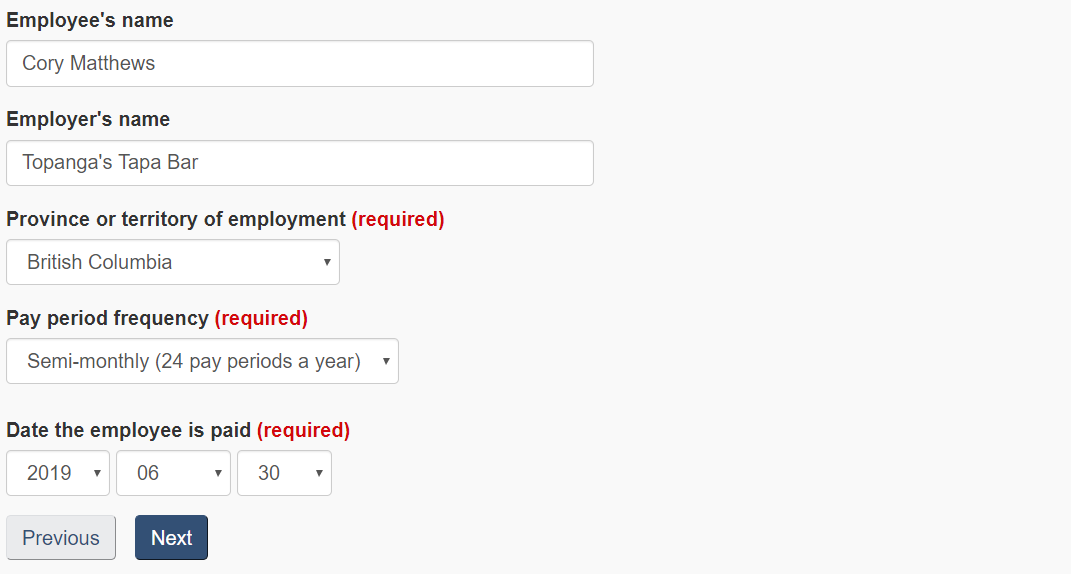

Missed or late payments will result in fines along with daily compound interest on any outstanding balance of 500 or more. How to use a Payroll Online Deductions Calculator You first need to enter basic information about the type of payments you make.

If you pay remuneration you need to remit deductions to the CRA.

Cra source deductions. Report a problem or mistake on this page. When source deduction and GSTHST withholdings are not paid when withheld or collected CRA enjoys enhanced security typically referred to super priority over most of a tax debtors real property and personal assets vis-a-vis other creditors by virtue of deemed trust provisions in the Income Tax Act and Excise Tax Act. Like the CRA increases the paycheck deductions according to inflation you can increase your income by investing in good dividend stocks through a.

My Business Account is the CRA portal where businesses can register and file their source deductions online. Federal provincial or territorial income tax. These employers must also reduce their CEWS claim for the amount of the TWS they are entitled to.

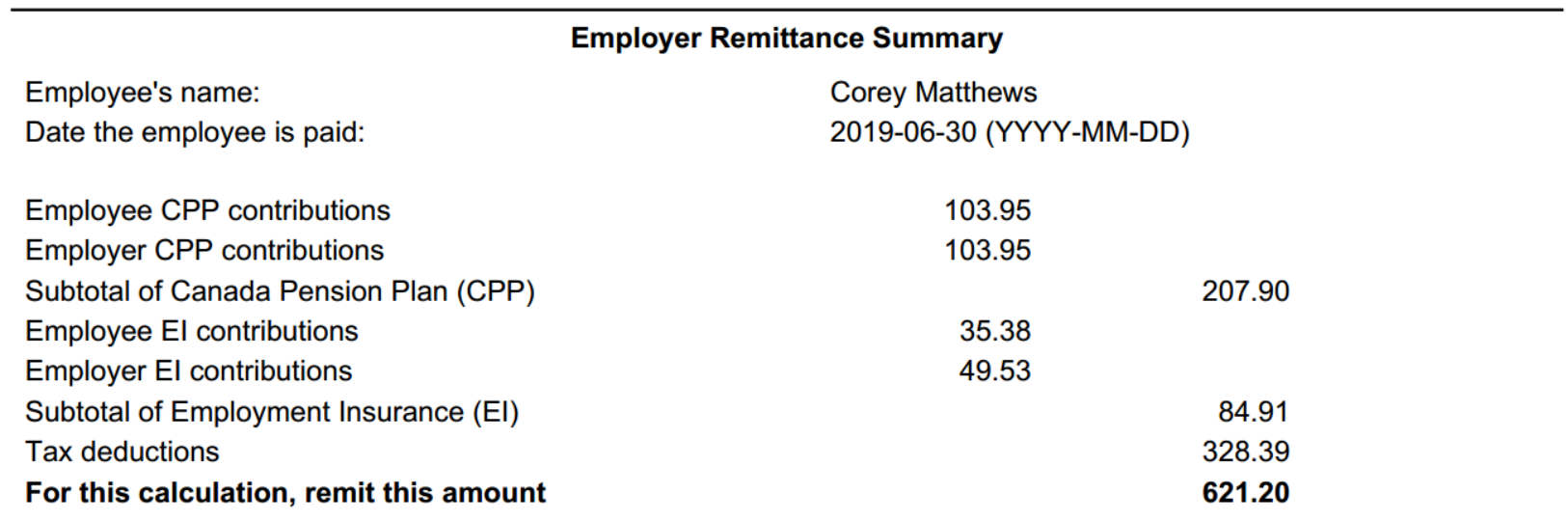

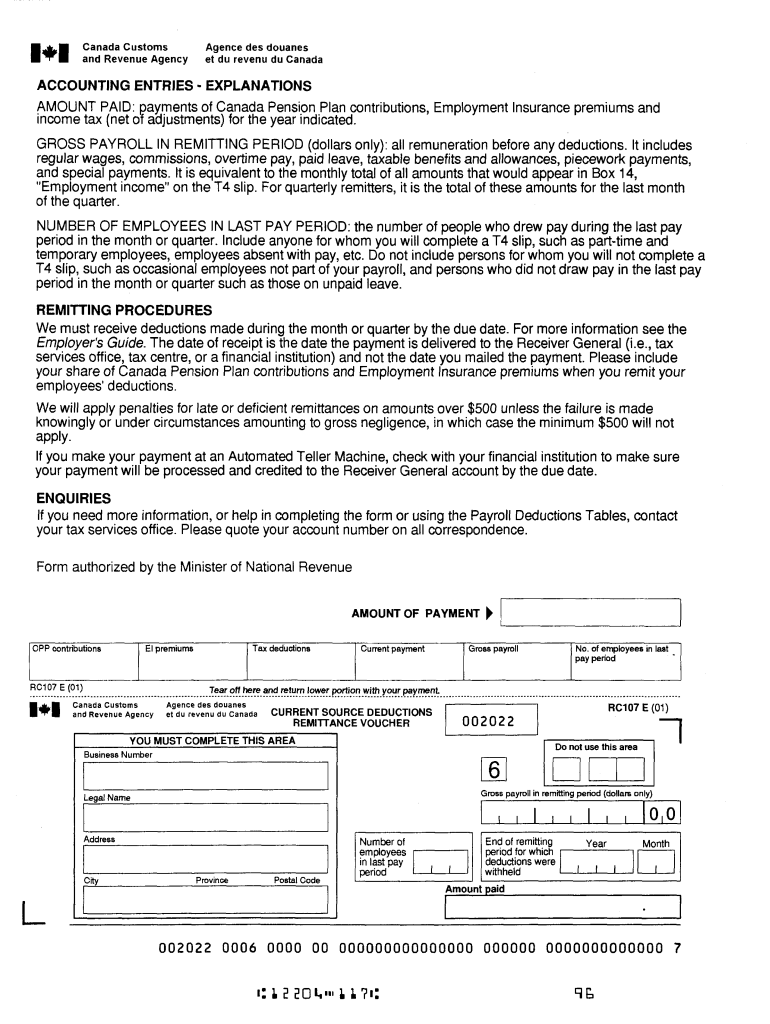

The source deductions you have to withhold and remit to the CRA may be any combination of. Current source deductions remittance voucher Form PD7A. The CRA said it would treat eligible employers that did not reduce their source deductions as having over-remitted their employee source deductions.

3 if your payment is 1-3 days late. The tool then asks you to enter the employees province of residence and pay frequency weekly biweekly monthly etc. Pay remit source deductions.

The payroll deductions required to be remitted to the Canada Revenue Agency. When and how to send us CPP contributions EI and income tax deductions report a nil remittance correct a remittance. Source deductions refers to the portion of pay youre legally required to withhold from your employees paychecks and remit to the Canada Revenue Agency on their behalf.

The CRAs current penalty structure is. It has a spelling mistake. Suppose they do not remit their source deductions on time including income taxes Canada Pension Plan contributions and Employment Insurance Premiums.

Canada Pension Plan CPP contributions. Deductions Moving expenses capital gains deduction workers Consumption Taxes Refund purchase donation exchange of road vehicles Self-Employed Persons. A link button or video is not working.

Paid all your goods and services taxharmonized sales tax GSTHST on time. Employment insurance EI premiums. Your payroll deductions source deductions must be held in trust in a separate account from your normal operating account.

The maximum total is 25000 for each eligible employer. Overview of remitting CRA source deductions Heres some information that will help you understand more about CRA remittances. If you continue to qualify the CRA will not tell you again.

If you qualify the CRA will tell you in writing in November following an annual review. Filed all your T4 type information returns and GSTHST returns on time. The subsidy is equal to 10 of the remuneration you paid from March 18 to June 19 2020 up to 1375 for each eligible employee.

What source deductions do you have to withhold and remit. Salary commission or pension. End of remitting period for which deductions were withheld.

The following information will help you fill in the boxes in this section of the form. Employers must meet specific remittance deadlines each year. Theyre made up of Canada Pension Plan contributions Employment Insurance premiums income tax taxable benefits and optional additional tax deductions.

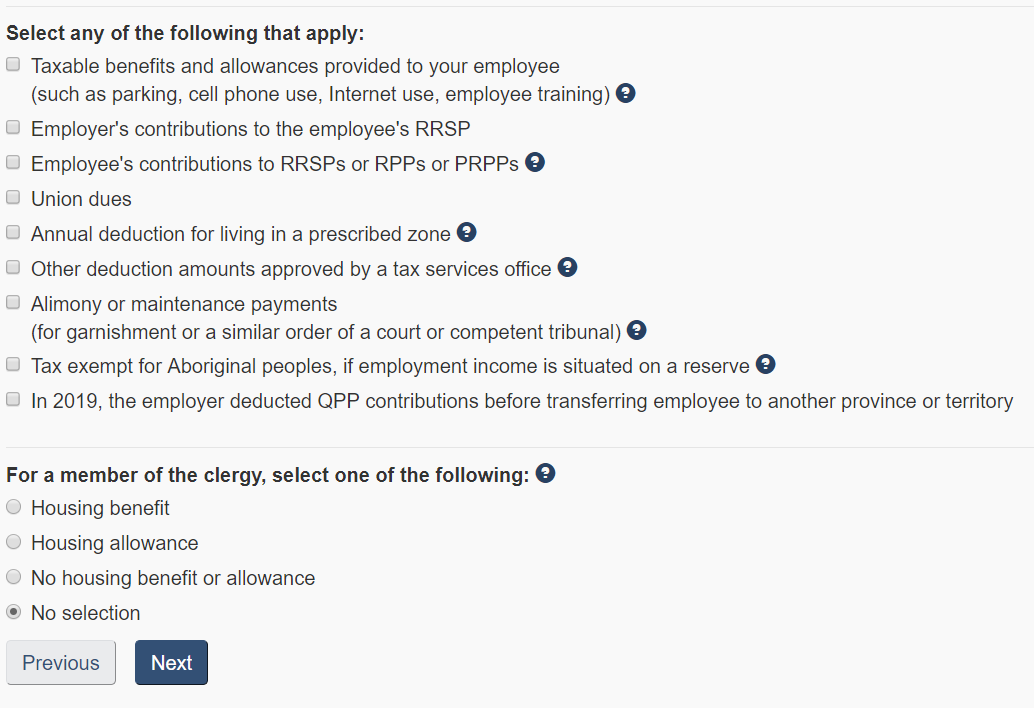

Please select all that apply. This includes employers administrators trustees and financial institutions. Remitted all your source deductions on time.

For quarterly remitters enter the year and last month of the quarter. For more information on the TWS go to canadacatemporary-wage-subsidy. For the remainder of 2020 the CRA will expect this change to be implemented on a best efforts basis.

Enter the year and month of the end of remitting period that you are remitting for. If this is the case you may see a difference between your pay and the Payroll Deductions. As a result your employer may be using a different Yukon Basic Personal Amount to calculate your pay.

You then have to remit these deductions to the Canada Revenue Agency CRA.

Chapter 4 How To Remit Payroll Deductions Your Complete Guide To Canadian Payroll Humi E Books

Chapter 4 How To Remit Payroll Deductions Your Complete Guide To Canadian Payroll Humi E Books

Cra Remittance Voucher Fillable Fill Online Printable Fillable Blank Pdffiller

Cra Remittance Voucher Fillable Fill Online Printable Fillable Blank Pdffiller

How To Submit Federal Payroll Deductions Payment To Cra Youtube

How To Submit Federal Payroll Deductions Payment To Cra Youtube

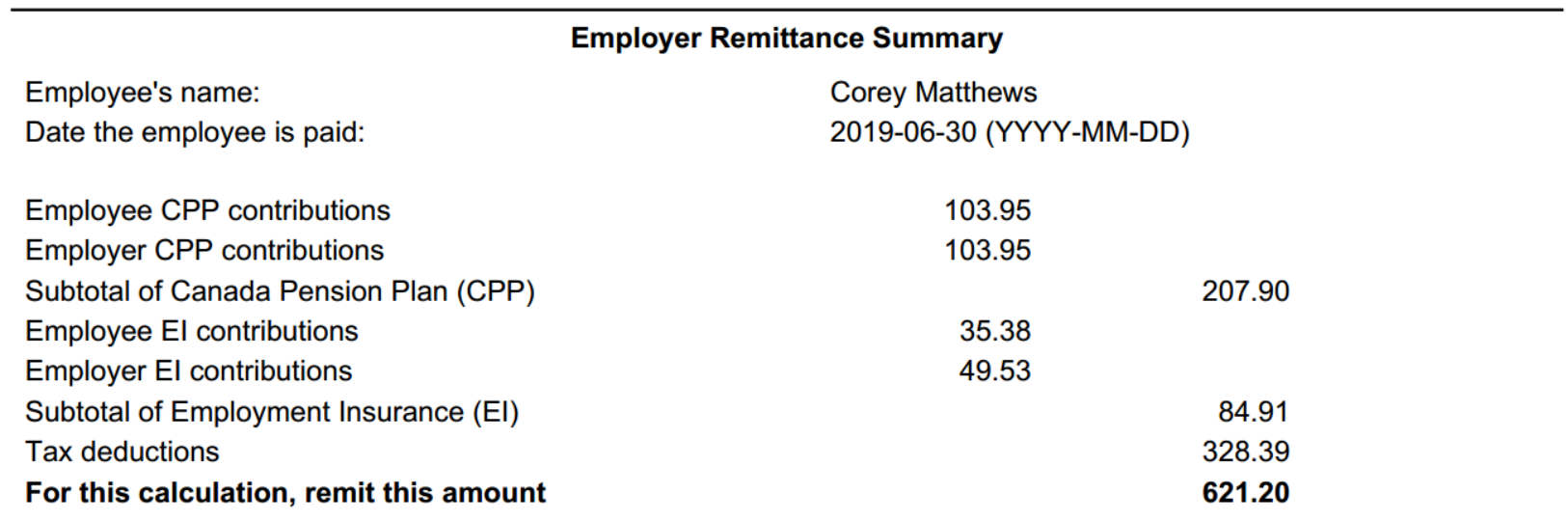

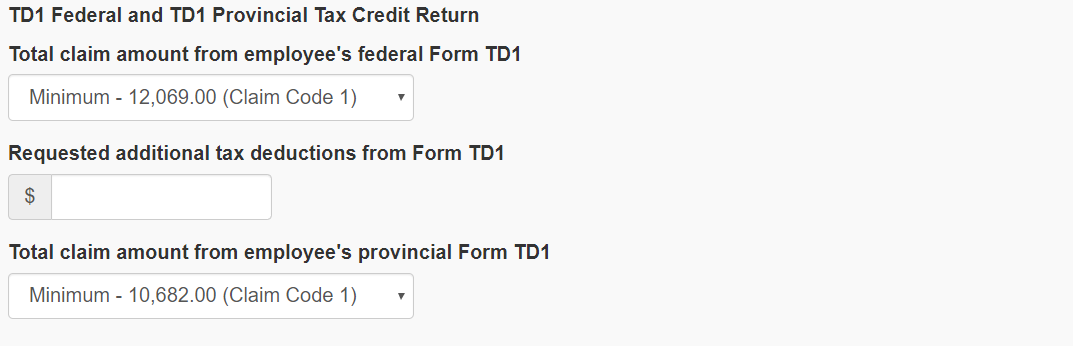

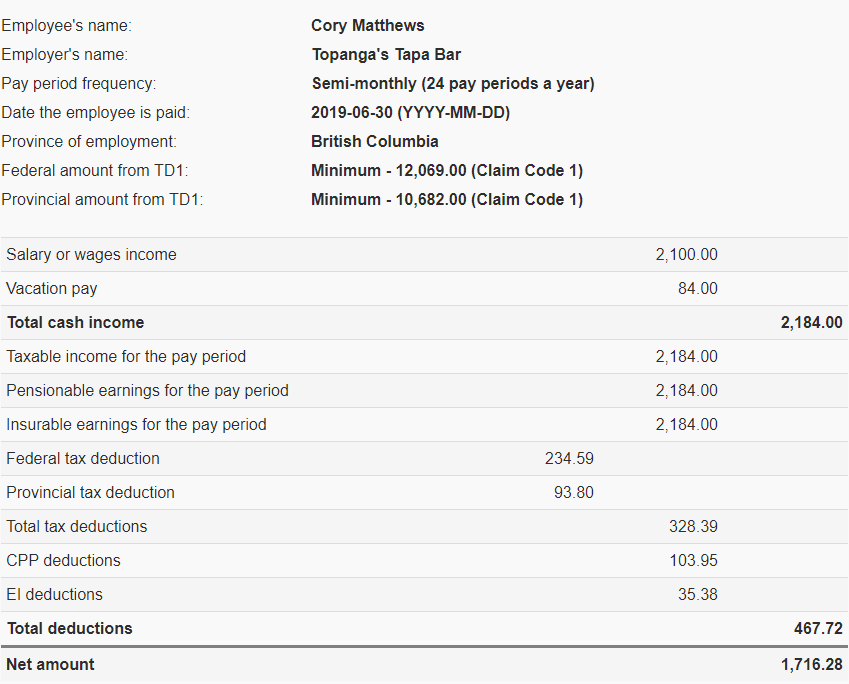

How To Calculate Payroll Deductions For Employee Simple Scenario By Sunray Liao Cpa Ca Medium

How To Calculate Payroll Deductions For Employee Simple Scenario By Sunray Liao Cpa Ca Medium

Pd7a Statement Of Account For Current Source Deductions Canada Ca

Pd7a Statement Of Account For Current Source Deductions Canada Ca

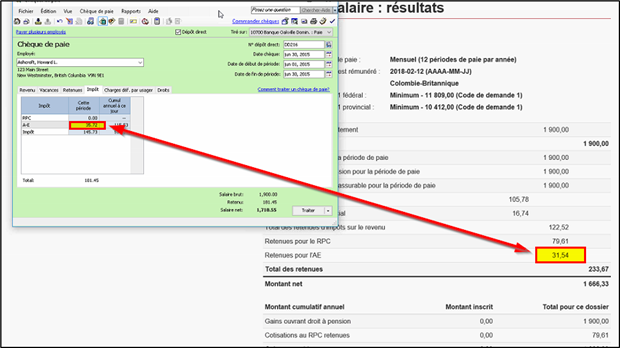

Source Deduction Remittance Spire User Manual 3 4

Source Deduction Remittance Spire User Manual 3 4

Source Deduction Remittance Spire User Manual 3 4

Source Deduction Remittance Spire User Manual 3 4

What Are Payroll Deductions Remittances Quickbooks Canada

What Are Payroll Deductions Remittances Quickbooks Canada

How To Use The Cra S And Revenue Quebec S Payroll Tax Calculators Sage 50 Ca Support And Insights Sage 50 Accounting Canadian Edition Sage City Community

How To Use The Cra S And Revenue Quebec S Payroll Tax Calculators Sage 50 Ca Support And Insights Sage 50 Accounting Canadian Edition Sage City Community

Popular Posts

-

Join Elyse Allan President and CEO GE Canada as she shares insights on the Future of Work including highlights from GEs new 2016 Global. El...

-

Ad Book your Hotel in Winnipeg MB online. Legislations Rules Regulations. 3 Best Driving Schools In Winnipeg Mb Expert Recommendations Y...

-

The Bull bar footboard rollbar and lights on top of the cabin can be added or removed via trainer. All mods for the model files and texture...

Featured Post

are spirits real

Are Spirits Real? Ayahuasca Wisdom . Spirits as metaphor, spirit as symbol; as psychological or chemical or real—a great deal has to d...

ads